📈 Our Four Trillion Dollar Companies

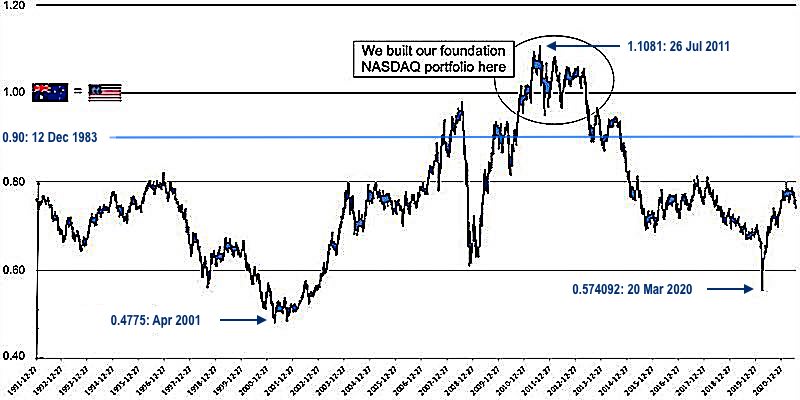

Apple [AAPL] Our longest-held NASDAQ stock is Apple, which we bought at an average of USD 16.76 (adjusted for share splits) from 21 Oct 2010. This was shortly after the release of the iPhone 4 by Steve Jobs on 8 Jun 2010. It was our first NASDAQ investment. As a result of the iPhone's success, and the success of subsequently released products, Apple has, until recently, become the world's most valuable (by market capitalization) company (that title is currently held by Microsoft: $3.06 trillion). . On 3 Jan 2022 Apple became the first company to achieve a USD 3 trillion market valuation, up 5,800% since listing on NASDAQ on 12 Dec 1980. With a share price of USD 168.00 (adjusted for 2 share splits: 7:1 and 4:1) Apple is currently valued at around

USD 2.594 trillion,

and pays quarterly dividends.

Alphabet [GOOG/L] Google was our second NASDAQ investment. Google later restructured itself with three classes of shares and renamed itself Alphabet. We hold Class A (GOOGL) and Class C (GOOG) shares. Because these two classes closely track each other we only mention GOOGL in our weekly reports. Alphabet achieved USD 2 trillion status (briefly) on 8 Nov 2021. GOOGL and GOOG market caps are currently reported to be USD 1.933 trillion, and USD 1.950 trillion. Alphabet's 20:1 stock split occurred on 18 Jul 2022.

Amazon [AMZN] After buying Amazon at USD 190.90 on 20 Jan 2011, we added to it through 4 years of low growth. Amazon's value significantly increased when analysts and investors appreciated the value of AWS. On 9 Mar 2022 Amazon's board approved a 20:1 share split plus a USD10 billion share buyback. The stock split was effective from commencement of trade on 6 Jun 2022. Amazon's last closing price (adjusted for the 20:1 split) was USD 181.28 and its market capitalization is currently USD 1.883 trillion.

Meta [META]

On 12 Sep 2012 we bought Facebook at USD 20.75 (just over half its USD 38.00 IPO price = market capitalization of USD 104 billion in May 2012). On 28 Jun 2021 Facebook achieved trillion dollar status with a share price of USD 355.64. With a share price of USD 494.17 Meta's market capitalization is currently USD 1.260 trillion.

Techinvestment.com is an Australian investor in technology companies.

Techinvestment.com is an Australian investor in technology companies. How our NASDAQ/NYSE portfolio has been doing

How our NASDAQ/NYSE portfolio has been doing