AI's Energy Requirements: IEA Forecasts

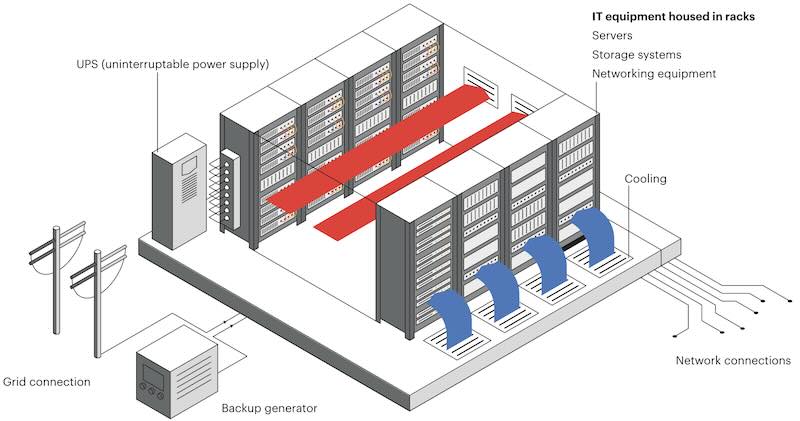

"Artificial intelligence (AI) model training and deployment occur mainly in data centres. Understanding the role of data centres as actors in the energy system first requires an understanding of their component parts. Data centres are facilities used to house servers, storage systems, networking equipment and associated components that are installed in racks and organised into rows."

IAEA: AI Energy Demand and Supply

International Atomic Energy Agency: AI Energy Demand

International Atomic Energy Agency: AI Energy Supply

Meeting AI's Energy Requirements

Here’s a structured, realistic estimate of the power generation capacity required to support U.S. AI-focused data centers over the next 5 years (to ~2030) and the next 10 years (to ~2035) — plus key initiatives underway to meet that demand. I’ll clearly distinguish estimates, drivers, and initiatives so you can see both the scale and response, with the most current assessments available.

This assessment was provided by ChatGPT in Jan 2026

1. Context: AI Data Centers & U.S. Power Demand Growth

Current State (2024–2025)

U.S. data centers consumed about 180–185 terawatt-hours (TWh) in 2024 (≈4–4.4% of total U.S. electricity use). AI workloads are a growing share of that.

National electricity demand is hitting record highs, partly due to data centers driving load growth.

Growth Trends

Data center electricity use in the U.S. is projected to double X1.7–3X by the late 2020s (e.g., 2023→2028).

AI is the primary driver of this surge, with hyperscale computing and new AI training workloads pushing energy needs much higher.

2. Estimated Power Capacity Needs (next 5 & 10 years)

Next 5 Years (to ~2030)

Total incremental power generation capacity needed (U.S., cumulative): ~47 GW

This is the additional supply utilities must add above existing capacity to support expected data center growth (AI + cloud + storage).

Translates to electricity consumption:

- If ~47 GW of new capacity runs ~60% capacity factor → ≈ 247 TWh/year additional generation (very rough conversion, acknowledging grid losses and seasonal variation).

Population of data center demand by 2030:

- U.S. data center electricity use could rise from ~180 TWh (2024) to ~426 TWh (2030) — a ~133% rise (quadrupling AI share).

- Data centers may then make up 6–9% of total U.S. generation by 2030.

Interpretation: AI and data centers collectively will drive a large chunk of US electricity growth through 2030. To keep the grid reliable, roughly 47 GW of incremental generation capacity (gas + renewables) is likely needed — plus grid upgrades and storage.

Next 10 Years (to ~2035)

Estimates vary widely, but scaled projections indicate dramatic growth:

- Deloitte projects AI data center power demand could grow from ~4 GW in 2024 to ~123 GW by 2035 if AI load becomes dominant.

- That aligns with other projections that show 30× growth in AI-specific load over 10+ years.

Implication:

Even assuming conservative utilization, total installed capacity serving AI data centers alone could approach 100+ GW by the mid-2030s — requiring hundreds of terawatt-hours/year of generation and robust transmission infrastructure.

Note: These long-range figures have more uncertainty because of efficiency improvements, AI optimization, hardware evolution, and national energy policies.

3. How the U.S. Is Responding: Major Initiatives

A. Generation & Infrastructure Buildout

Utility-level capacity expansion

Georgia approved ~10,000 MW (10 GW) additional generation mainly for data center demand — one of the biggest single generation expansions in U.S. history.

Federal and regional grid operators (e.g., PJM) are revising planning frameworks to accommodate fast-growing AI loads and avoid shortfalls.

Utility grid planning includes:

- Fast-track interconnections

- Demand management and curtailment agreements

- Prioritizing reliability while meeting AI demand spikes

B. Renewables & Clean Energy Projects

- The U.S. Department of Energy (DOE) supports a portfolio approach, boosting renewables (wind, solar) and complementary technologies (storage, grid modernization).

- Many tech companies are signing direct renewable power purchase agreements (PPAs) to ensure long-term clean supply.

- In 2024, ~90% of newly added U.S. capacity was from renewables (solar, wind).

C. Nuclear Energy & Long-Term Baseload

- Google signed deals for 50+ MW nuclear capacity, with plans reaching ~500 MW by 2035, to power data centers.

- Interest in small modular reactors (SMRs) and advanced nuclear is growing — but most deployment isn’t expected until the 2030s.

D. Grid Modernization & Demand Side Innovation

Utility and industry responses include:

- Demand response programs can unlock tens of GW of “virtual capacity” by flexibly shifting loads rather than building new generation.

- Transmission upgrades to connect remote renewable resources.

- AI and smart grid technologies for real-time balancing and forecasting.

E. Government & Stakeholder Initiatives

A White House task force (2024) brought together hyperscalers, utilities, and regulators to coordinate energy infrastructure planning and permit reform. It was led by the National Economic Council, National Security Council, and the White House Deputy Chief of Staff’s office, coordinates federal policy across agencies to advance AI data center development in alignment with economic, national security, and environmental objectives. White House consideration of the Task Force Report: Oct 2024.

4. Key Risks & Constraints

Grid bottlenecks & interconnection delays are slowing new data center hookups.

Regional supply shortfalls could constrain 40% of planned AI data centers by 2027 unless generation and grid upgrades speed up.

Environmental and cost pressures arise when fossil fuels are used to meet rapid demand spikes, complicating climate goals.

Summary Estimates: Power Generation for U.S. AI Data Centers

| Timeframe | Estimated Incremental Capacity Needs | Notes |

|---|---|---|

| Next 5 years (~2030) | ~47 GW new generation | Enough for ~200–250 TWh/year + grid upgrades |

| Next 10+ years (~2035) | Potential ~100–123+ GW for AI alone | Bigger unknowns; driven by AI load growth |

| Data center share of U.S. power | ~6–9% by 2030 | Growth driven by AI demand |

Bottom Line

- AI-driven electricity demand is a major driver of U.S. power growth for the next decade and beyond.

- Meeting that demand will require tens of gigawatts of new capacity (gas, renewables, nuclear) plus grid upgrades and smarter load management.

- Policy, private sector investment, and technological innovation are all critical to ensuring reliable, affordable, and lower-carbon power as AI scales.

Investment Opportunities: Key NASDAQ/NYSE listed power companies supporting AI

- Constellation Energy Corporation (NASDAQ: CEG): As the largest U.S. operator of nuclear power plants, Constellation is a major player in supplying carbon-free energy to tech giants like Microsoft and Meta. Generating >55GW.

- Talen Energy Corporation (NASDAQ: TLN): Talen has secured 20-year power purchase agreements with major tech companies (specifically Amazon) to supply nuclear power directly to AI data centers. News

- Fluence Energy, Inc. (NASDAQ: FLNC): A company that provides grid-scale battery systems, crucial for storing renewable energy and ensuring reliable, constant power for data centers. News: Australia

- American Electric Power Company, Inc.(NASDAQ: AEP): Identified as a key player in the AI-driven energy sector.

- Oklo Inc.(NYSE: OKLO): While NYSE-listed, Oklo is closely associated with AI-driven energy and often categorized with NASDAQ tech-energy trends): Focused on next-gen small modular reactors, with significant backing from OpenAI's Sam Altman.

Investment Action:

- Buy Constellation Energy Corporation (NASDAQ: CEG)

- Sell IBM