TechInvestment.com [Bunting Pty Ltd: ABN 64 096 255 668] is a long equity investor founded almost 25 years ago in March 2001. It invests in NASDAQ and NYSE listed technology companies.

The company's portfolio was created with AUD 100,000 invested in Apple (98%) and Google (2%).

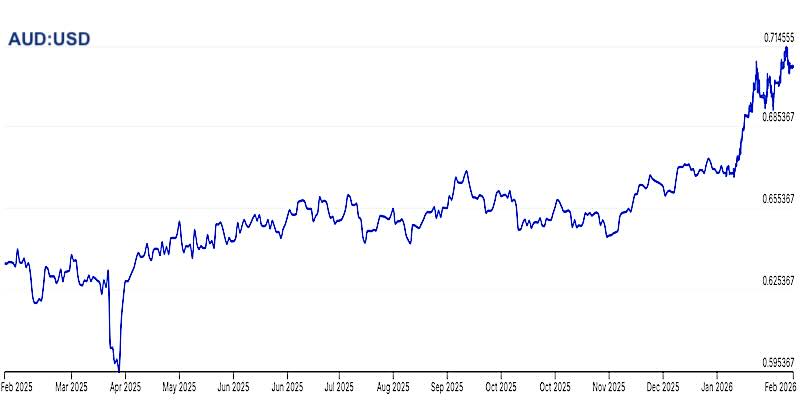

As at 20 February 2026 that portfolio was valued at USD 18.547 million = AUD 26.185 million [AUD:USD 0.70426281].

Our focus is on advanced technologies, including:

A tensor processing unit (TPU) is a custom-developed, application-specific integrated circuit (ASIC) designed by Google specifically to accelerate tensor flow machine learning (ML) workloads. Unlike general-purpose CPUs or graphics-focused GPUs, tensor core GPUs are engineered for the high-volume matrix and tensor operations fundamental to neural networks. TPUs are available via Google Cloud. Nvidia TPU models include A100, H100, H200, B200 and B300 (where the codes are A: Ampere, H: Hopper, B: Blackwell).

We look forward to the opportunity to invest in Tesla's Optimus Gen 3 robots - perhaps even buying one for evaluation and public exposure and demonstration in Australia.

In 2025 sovereign wealth and public pension fund investors poured USD132 billion, roughly half of their total investments for the year, into USA. Sovereign wealth funds managed USD 66 billion in AI and digitisation in 2025, according to the Global SWF Year in Review 2025: The Ideas, Power Shifts and Structures That Defined Sovereign Capital", 30 Dec 2025.

US economic, trade, political and international issues in 2026 create a great deal of uncertainty (risk) in US investment. This may also increase AUD:USD currency risk - which may represent an additional cost to our AUD-denominated portfolio.

Most of our strategic investments are in NASDAQ and NYSE in USA. This is because:

Our portfolio includes all of the "Magnificent Seven" companies: Apple, Alphabet, Amazon, IBM, Meta, NVIDIA and Tesla.

The sum of market capitalisations of the 12 stocks in our portfolio at 31 Dec 2025 was about USD 22.805 trillion, about AUD 34.124 trillion.

The Composition of TechInvestment's Portfolio [As at 20 Feb 2026]

The Structure and Performance of TechInvestment's Portfolio [As at 20 Feb 2026]

| Ticker | Company | Weight | Mkt Cap USD |

*Profit AUD |

**12 Month Growth |

News |

|---|---|---|---|---|---|---|

| AAPL | Apple, Inc | 67.14% | 3.87 tn | ▲ 2,142.20% | ▲ 7.63% | News |

| AMZN | Amazon.com, Inc | 5.66% | 2.25 tn | ▲ 960.82% | 🔻 5.73% | News |

| CEG | Constellation Energy | 0.16% | 91.70 bn | ▲ 6.76% | 🔻 4.71% | News |

| GOOG | Alphabet, Inc Class A | 4.24% | 3.83 tn | ▲ 1,282.56% | ▲ 68.72% | News |

| GOOGL | Alphabet, Inc Class C | 5.43% | 3.83 tn | ▲ 355.69% | ▲ 70.67% | News |

| META | Meta (Facebook) | 3.54% | 1.66 tn | ▲ 4,472.47% | 🔻 5.64% | News |

| NVDA | Nvidia | 1.94% | 4.58 tn | ▲ 36.34% | ▲ 35.48% | News |

| PLTR | Palantir | 0.73% | 318.62 bn | ▲ 38.09% | ▲ 27.26% | News |

| QBTS | D-Wave Quantum | 9.30% | 6.84 bn | ▲ 308.23% | ▲ 144.38% | News |

| RGTI | Rigetti Computing | 1.67% | 5.24 bn | ▲ 25.63% | 🔻 38.80% | News |

| TSLA | Tesla | 0.13% | 1.29 tn | 🔻 8.36% | ▲ 16.20% | News |

*Profit = Profit since acquisition, as calculated and reported by CMC Markets

**12 Month = Price increase over the past 12 months, as calculated and reported by Google Finance.

✅ OpenAI is planning an IPO in Q4/2026, ahead of Anthropic's . More Anthropic's floated valuation is expected to be USD 350 billion. [Wall Street Journal: 29 Jan 2026]

✅ Amazon is building an AI datacenter on 1,200 acres in Northern Indiana. It will support 500,000 AWS Trainium 3 chips. It is expected to be completed by the end of 2025 and will create 1,100 new jobs.

AWS Indiana data center under construction, supported by a ✅ Constellation Energy power station.

✅ Amazon is planning to invest up to USD 50 billion in OpenAI [WSJ: 29 Jan 2026].

✅ Amazon is planning to raise USD 25 billion as Anthropic's valuation soars. Anthropic is considering going public through an IPO later in 2026 after a big capital raise. More Amazon's Anthropic's floated valuation is expected to be USD 350 billion. [New York Times]

It is reported that USA may, in the near term, face a political crisis as Congress proposes impeachment and removal of Donald Trump as President.

The most significant elections in 2026 (with potential impacts on economic or investment environments) are:

Quantum Computing

ChatGPT comment: "The strange part isn’t that quantum computing is hard. It’s that we ever expected it to be otherwise."

22 Jan 2026: 🇦🇺 Australia – 🇯🇵 Japan Quantum Computing Partnership launches on international stage. The agreement focuses on integrating quantum computing with supercomputing to accelerate scientific breakthroughs at the annual supercomputing conference in the region. Australia’s CSIRO, on behalf of the Pawsey Supercomputing Research Centre, has signed a Letter of Intent with Japan’s National Institute of Advanced Industrial Science and Technology (AIST) to strengthen scientific cooperation in quantum computing.

In 2024 IBM and PsiQuantum were awarded DARPA US2QC grants to develop a fully fault-tolerant quantum computer with logical qubits protected by quantum error correction (primarily surface-code-style schemes) for its Validation and Co-Design stage of the Underexplored Systems for Utility-Scale Quantum Computing (US2QC) program, one of two programs that make up DARPA’s larger Quantum Benchmarking Initiative (QBI). The goal of the QBI is to see if an industrially useful quantum computer can be built by 2033.

As of Feb 2026 PsiQuantum has successfully completed the initial research and development validation stages of the DARPA US2QC program and, as of Feb 2025, has advanced to the final phase (Validation & Co-Design). IBM has not completed the Validation and Co-design stage of the US2QC Program.

As of Feb 2026 there is no public evidence that PsiQuantum has delivered a full, fault-tolerant, utility-scale system — either under US2QC or from any other grant (eg Australia's grant: reported to be "on the rocks").

Microsoft Azure Quantum was also awarded a contract similar to that for PsiQuantum.

Companies selected for Stage B include:

IonQ was an early addition to our quantum computing portfolio, but was dropped in Feb 2026 following publication of Wolfpack research that "IonQ did not disclose to investors the extent to which its reported revenues had been dependent on 'backdoor earmarks' inserted into the Pentagon budget by friendly lawmakers — and that those earmarks were canceled after the Republicans took control of Congress in 2025." [Fortune: 4 Feb 2026]

ChatGPT notes that PsiQuantum is not included in Stage B of the US2QC program.

ChatGPT reports: "The Australian Commonwealth government and the Queensland Government each committed around AUD 470 million (for a combined total of about AUD 940 million, often rounded to close to AUD 1 billion) to PsiQuantum. This funding package includes a mix of equity purchases, grants, and loans to the company.

The deal is part of Australia’s Future Made in Australia initiative, aimed at developing advanced technology sectors and high-skilled jobs locally, with PsiQuantum agreeing to locate major operations, manufacturing, and partnerships in Brisbane.

PsiQuantum is a quantum computing company headquartered in Palo Alto, California, with Australian co-founders and roots in research at the University of Queensland, but the company itself is not an Australian-owned entity."

In Feb 2025 PsiQuantum was expected to begin work on its Brisbane airport facility and "fast track" its technical development [AFR 20 Feb 2025].

The proposed PsiQuantum site at Brisbane airport

However a year later AFR reports that while construction of PsiQuantum’s world-leading super computer was expected to start in 2025, there are still no signs of movement at the vacant 13-hectare site tucked behind Brisbane Airport. One of the first steps in the approvals process – a two-month public consultation period – is yet to begin, putting pressure on the tech giant’s ambitious time frame for the project." [AFR 13 Feb 2026]

Artificial Intelligence

16 Jan 2026: Anthropic (Claude AI) to open an office in 🇦🇺 Australia

13 Jan 2026: ✅ Meta cuts 10% of employees in its Reality Labs (VR Metaverse) division

13 Jan 2026: ✅ Meta unveils 'Meta Compute' initiative to build AI infrastructure

13 Jan 2026: ✅ Meta pivots from Metaverse to AI devices such as RayBan Meta AI glasses.

12 Jan 2026: Bloomberg: ✅ Apple and ✅ Google confirm a multi-year deal for Gemini to run AI-powered Siri later in 2026.. Barron's reports that Google is now the top AI company as ✅ Alphabet stocks rise past USD 4 trillion.

10 Jan 2026: ✅ Meta signs multi-gigawatt nuclear deals to power AI

23 Jul 2025: 🇺🇸 White House AI Action Plan

Semiconductors

26 Jan 2026: ✅ Nvidia invests additional USD 2.8 billion in CoreWeave AI chip [AFR].

26 Jan 2026: Microsoft takes aim at ✅ Google, ✅ Amazon, and ✅ Nvidia with new Maia 200 AI chip [Yahoo Finance].

26 Jan 2026: Microsoft has announced the launch of its latest chip, the Maia 200, which the company describes as a silicon workhorse designed for scaling AI inference. The Maia 200, which follows the company’s Maia 100 released in 2023, has been technically outfitted to run powerful AI models at faster speeds and with more efficiency. Maia comes equipped with over 100 billion transistors, delivering over 10 petaflops in 4-bit precision and approximately 5 petaflops of 8-bit performance — a substantial increase over its predecessor.

Inference refers to the computing process of running a model, in contrast with the compute required to train it. As AI companies mature, inference costs have become an increasingly important part of their overall operating cost, leading to renewed interest in ways to optimize the process.[TechCrunch 26 Jan 2026]

16 Jan 2026: Hardware firms hit by rising memory chip costs. [Bloomberg]

15 Jan 2026: TSMC, the world's largest contract chipmaker, posted a Q4/2025 record profit: up 35% to USD 16.01 billion [Reuters] TSMC Forecast Lifts Peers on Robust AI Demand [Bloomberg]

8 Jan 2026: US Commerce Department approves ✅ Nvidia H200 AI chip sales to China.

8 Jan 2026: China plans to approve some imports of ✅ Nvidia’s H200 chips as soon as this quarter. [Bloomberg] "This move represents a major win for Nvidia. China is the world’s largest market for semiconductors, and Chief Executive Officer Jensen Huang has said that the AI chip segment alone could generate USD 50 billion in the coming years." About the Nvidia H200 chip.

14 Jan 2026: Washington permits ✅ Nvidia to sell its H200 chip to China.

Energy

16 Jan 2026: President Trump and the governors of several US Northeastern states agreed to push for an emergency wholesale electricity auction that would compel technology companies to effectively fund new power plants [Bloomberg].

Techinvestment.com is an investor in ✅ Constellation Energy (CEG), which has 55 gigawatts of capacity from nuclear, natural gas, geothermal, hydro, wind and solar facilities. Constellation partners with Calpine LLC, America's largest generator of electricity from natural gas and geothermal resources with operations in competitive power markets. The fleet of 79 energy facilities in operation represents over 27,000 megawatts of generation capacity.

Data Centers

2 Feb 2026: More than USD 3 trillion is expected to be spent building the data centers needed for the AI boom, and much of the funding is coming from debt markets [Bloomberg].

FX: AUD:USD

Investment in US listed companies involves investment in assets denominated in USD. The AUD/USD currency exchange rate is therefore of short and long term interest.

US Politics

US political uncertainty/chaos and policies (eg tariff uncertainty) also have an impact on valuation of stocks, so we're interested in the very unstable performance of US politics and politicians, especially when the chickens come home to roost.

US General Staff have refused to carry out President Trump's orders, declaring those orders illegal. [Washington Post: 13 Jan 2026].

A schedule of 604 legal cases related to Trump administration executive actions